Table of ContentsThe smart Trick of Payroll That Nobody is Talking About4 Simple Techniques For PayrollAll about Payroll

An illustration of a advantage contribution can be a health insurance plan reimbursement for finishing a annually screening. An additional instance is instructional reimbursements, wherein you could possibly compensate an staff for attending classes linked to their position or pursuing a college diploma.Our versatile on line HR and payroll Remedy is easy to use and frees you as many as focus far more of your time and expertise on what you price most.But comprehension Just about every ingredient of payroll may well assist you much better realize your online business finances. And it can assist ensure you stay compliant with federal and state tax and labor regulations.

The Payroll Diaries

Fascination About Payroll

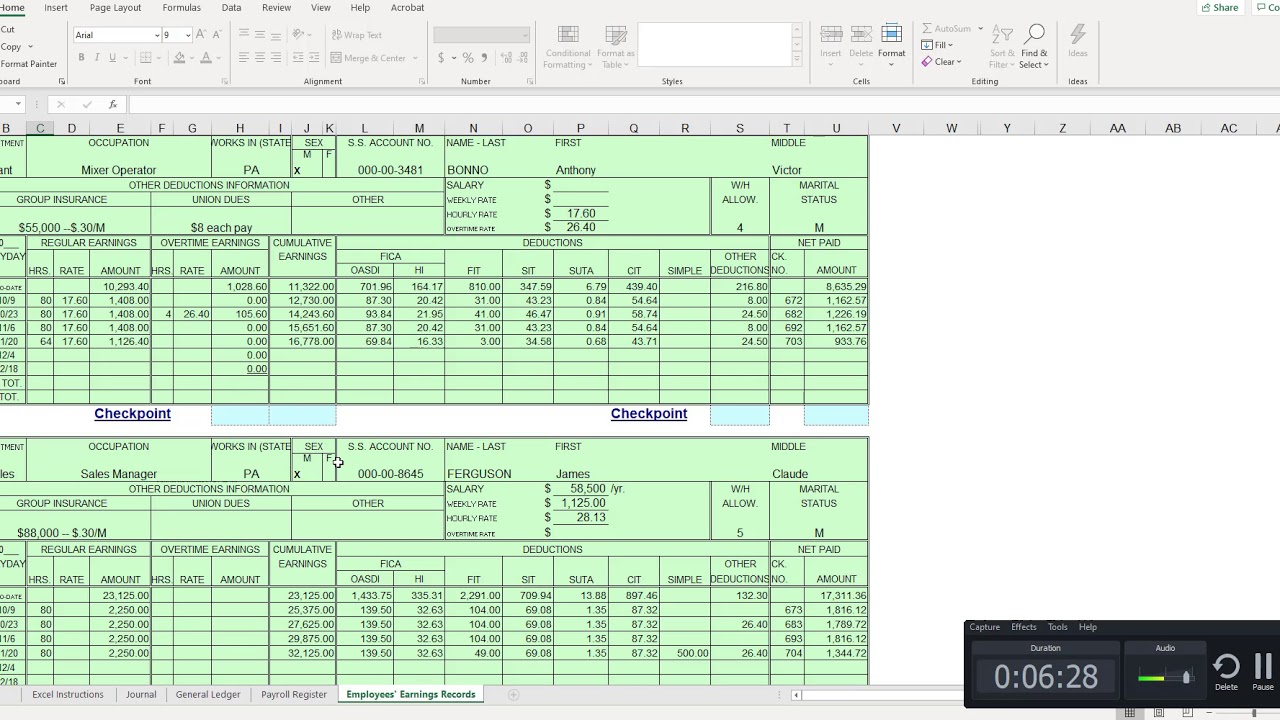

Payroll calculation: This can be the stage in the payroll course of action the place input facts is put into your payroll technique to actually system the payroll. This method results in Web pay out being created right after changing essential taxes and deductions.No–our program is just accessible to organizations with staff members Operating while in the USA. It’s our passion that can help American businesses by delivering streamlined, read more easy, and reasonably priced payroll administration options.Intuit Inc. does not have any accountability for updating or revising any info introduced herein. Accordingly, the knowledge provided shouldn't be relied on as an alternative for unbiased study. have a peek at this web-site Intuit Inc. isn't going to warrant that the fabric contained herein will carry on being accurate nor that it is totally freed from errors when revealed. Audience ought to confirm statements right before relying on them.To learn about how we use your facts, please Read through our Privateness Policy. Needed cookies will keep on being enabled to provide core features such as safety, community administration, and accessibility. You might disable these by changing your browser options, but this could impact how the website features.appear into play at that time. To be a first step, these kinds of insurance policies have to be very well defined and acquire permitted by the management to guarantee standard payroll processing.